Dakota Gold Corp. Reports Additional Drill Results from the Richmond Hill Gold Project in South Dakota

January 16, 2024

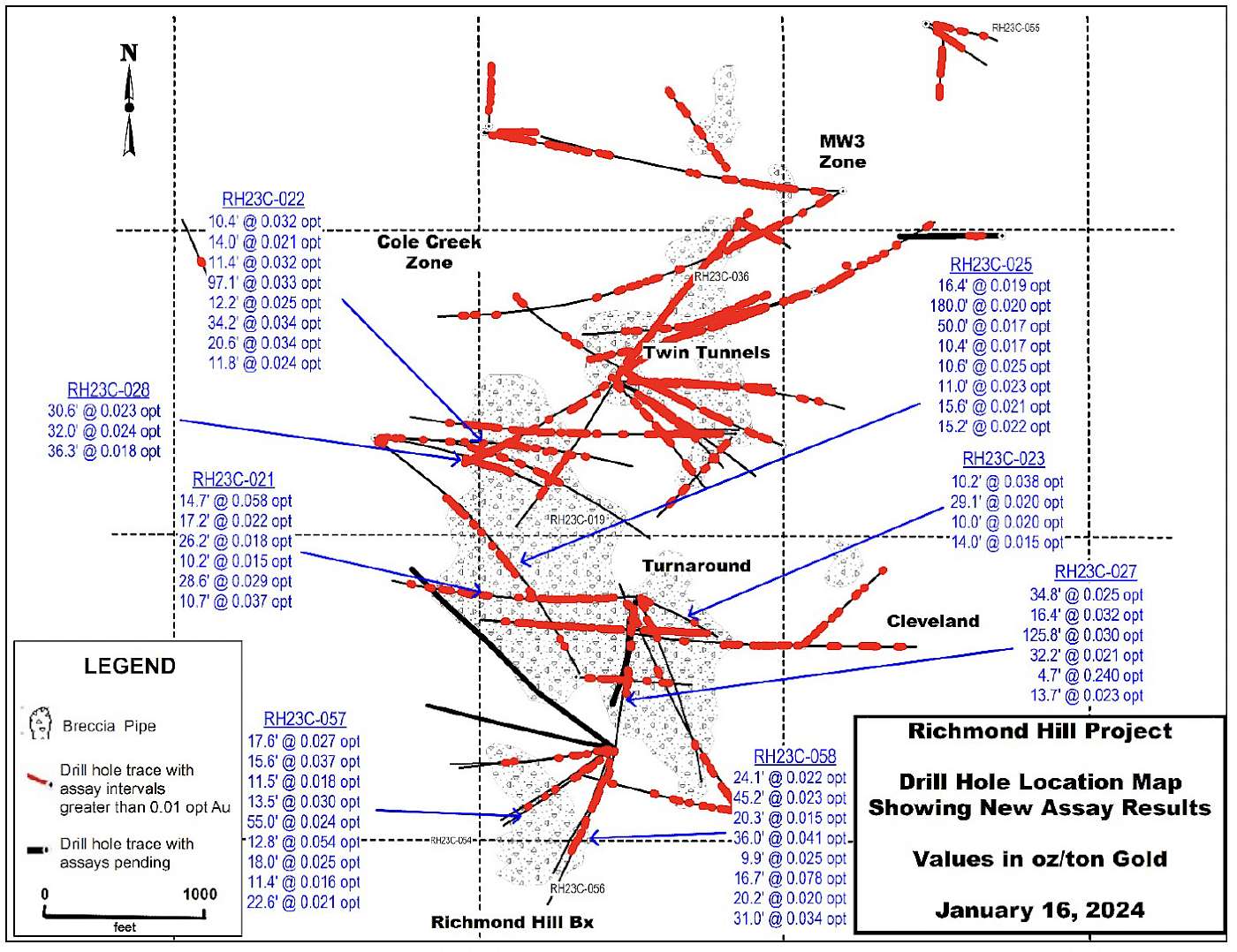

LEAD, SOUTH DAKOTA - Dakota Gold Corp. (NYSE American: DC) (“Dakota Gold” or the “Company”) is pleased to report assays from eight drill holes at the Richmond Hill Gold Project (“Richmond Hill”) in South Dakota. These drill holes were designed to test the Turnaround and the Richmond Hill Breccia Pipes. The drill holes at the Turnaround Breccia Pipe continue to identify gold mineralization in and around the breccia pipes below historical drilling. The drill holes at the Richmond Hill Breccia Pipe have identified shallow oxide material east of the historical Richmond Hill open pit mine. The drilling has extended the gold mineralization in and around the three known larger breccia pipes at Richmond Hill.

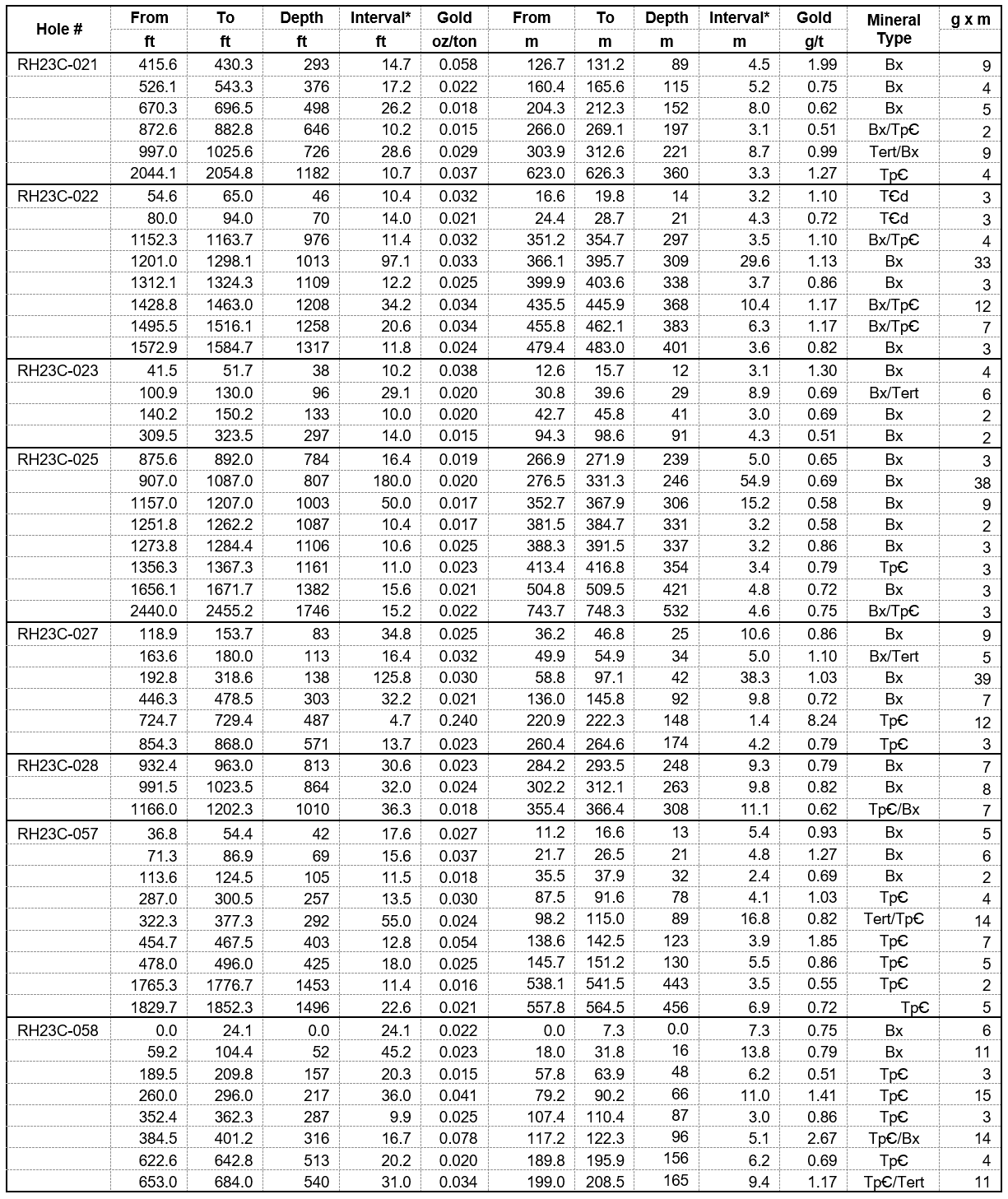

Highlights (See Table 1)

- RH23C-022 intersected 0.033 oz/ton Au over 97.1 feet (1.13 grams/tonne over 29.6 meters); RH23C-025 intersected 0.020 oz/ton Au over 180 feet (0.69 grams/tonne over 54.9 meters; and RH23C-027 intersected 0.030 oz/ton Au over 125.8 feet (1.03 grams/tonne over 38.3 meters) in the northern part of the Turnaround Breccia Pipe at depth. These holes also contain numerous narrower zones of similar grade throughout their length suggesting the breccia pipe hosts significant gold mineralization at deeper levels within the breccia pipe.

- RH23C-057 and RH23C-058 were drilled directly beneath previously reported drill holes RH23C-054 and RH23C-056 respectively (see News Release November 21, 2023). Both drill holes returned results similar to the earlier holes indicating extensive gold mineralization remaining in the wall rock adjacent to the historical Richmond Hill open pit mine.

- The results being reported in this release were returned after the cutoff date for the database that is being used for the resource estimation for the Company’s upcoming S-K 1300 compliant maiden resource, which is in progress and planned for completion in the first quarter of 2024 and indicate potential for significant expansion of mineralization outside the known historical resource areas.

James Berry, Vice President Exploration of Dakota Gold, said, “The Richmond Hill mineral system just keeps getting bigger. These exploration drill holes have expanded the Richmond Hill gold mineralization and further demonstrates the importance of the Tertiary-aged breccia bodies as a primary host rock for gold mineralization. Additional exploration to identify and expand mineralization in three known breccia pipes on the property will be incorporated in our future exploration drill program. In addition, we are reviewing the ongoing resource estimation work, that does not include these new results, to identify areas which present opportunity for additional inferred mineralization that could be added to future resource estimates.” Berry continued, “The gold mineralization at Richmond Hill continues to expand and is open to extension in all directions and to depth.”

Exploration Update:

RH23C-021

RH23C-021 was designed to test an undrilled area between the mapped Richmond Hill and Turnaround Breccia Pipes. Specifically, it was drilled to the west to test the deeper extents of the west side of the property and the southern edge of the Turnaround Breccia Pipe. Both breccia pipes and greenstones encountered in the drill hole returned narrow, but significant gold grades at depth.

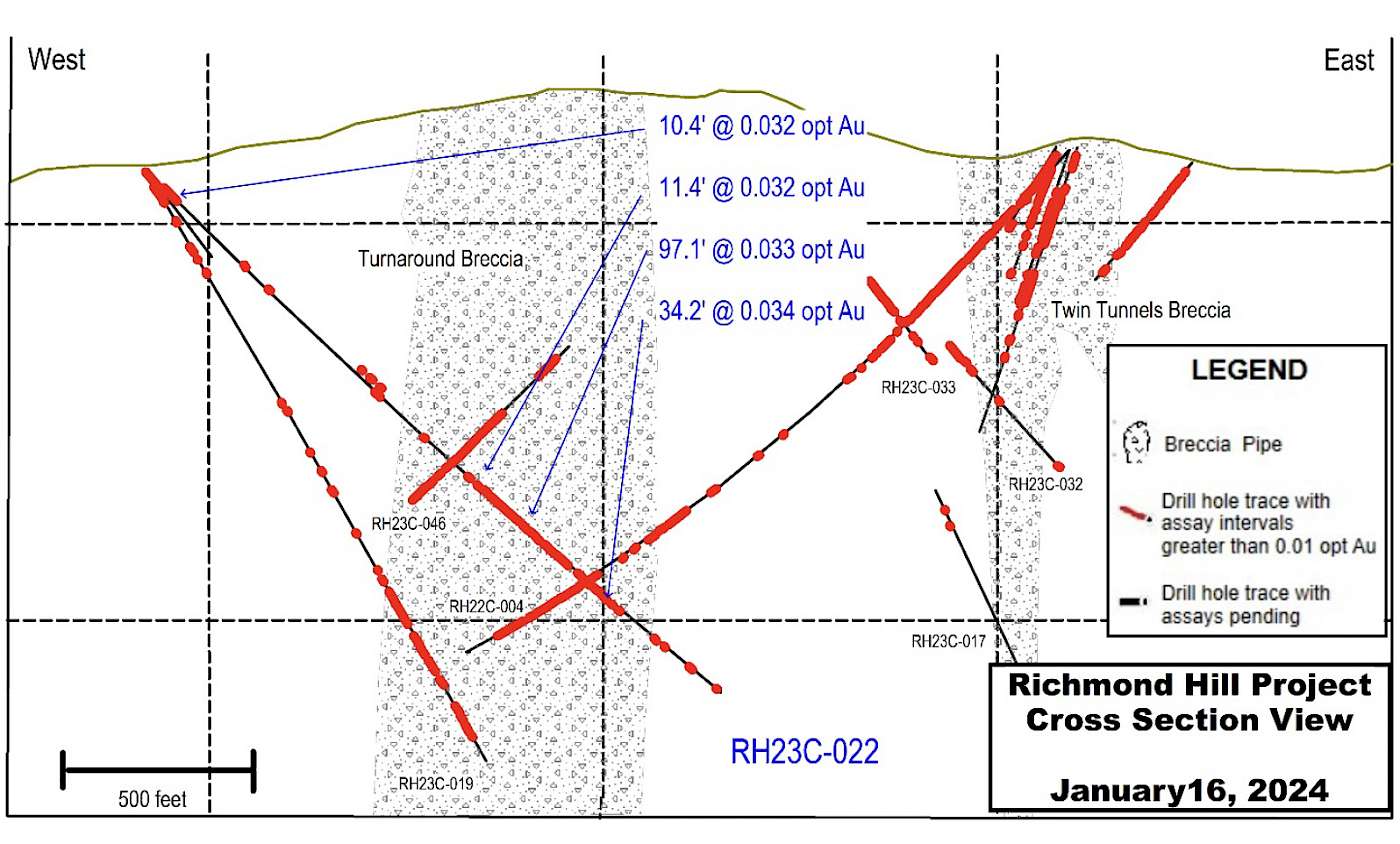

RH23C-022

RH23C-022 was designed to test the northwest side of the northern part of the Turnaround Breccia Pipe at depth. The drill hole encountered near surface gold mineralization in the Deadwood Formation and encountered a broad zone of gold mineralization in the breccia pipe. The best interval was 0.033 oz/ton Au over 97.1 feet (1.13 grams/tonne over 29.6 meters) within the breccia pipe.

RH23C-023

RH23C-023 was designed to drill across the east margin of the Turnaround Breccia Pipe towards the Cleveland area to cross the contact with the Precambrian Flagrock Formation at depth. Only narrow, near surface gold intercepts were encountered in this area of the breccia pipe.

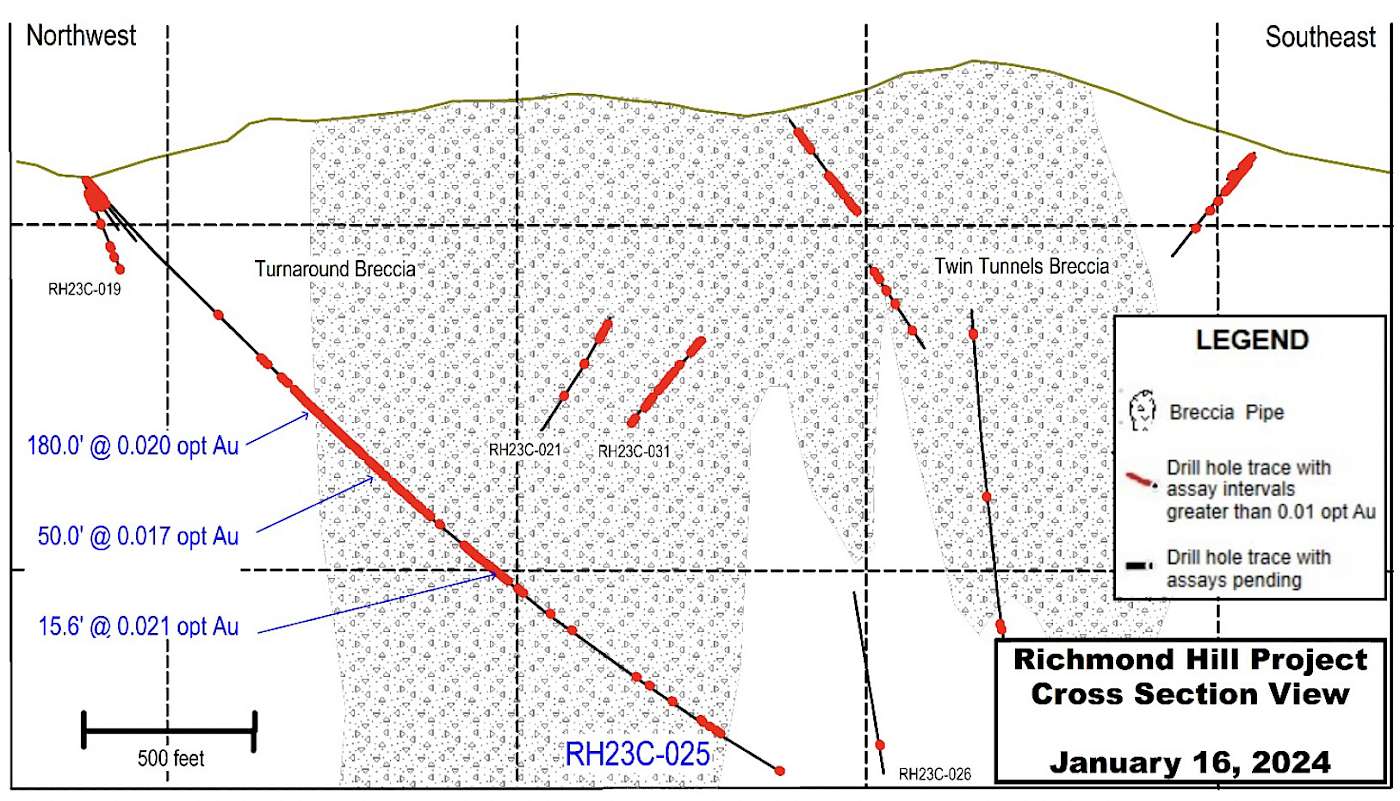

RH23C-025

RH23C-025 was drilled from the west side of the northern Turnaround Breccia Pipe to depth and drilled through a large section of the deeper breccia pipe. Numerous mineralized gold intervals were encountered, and the best intercept was 0.020 oz/ton Au over 180 feet (0.69 grams/tonne over 54.9 meters).

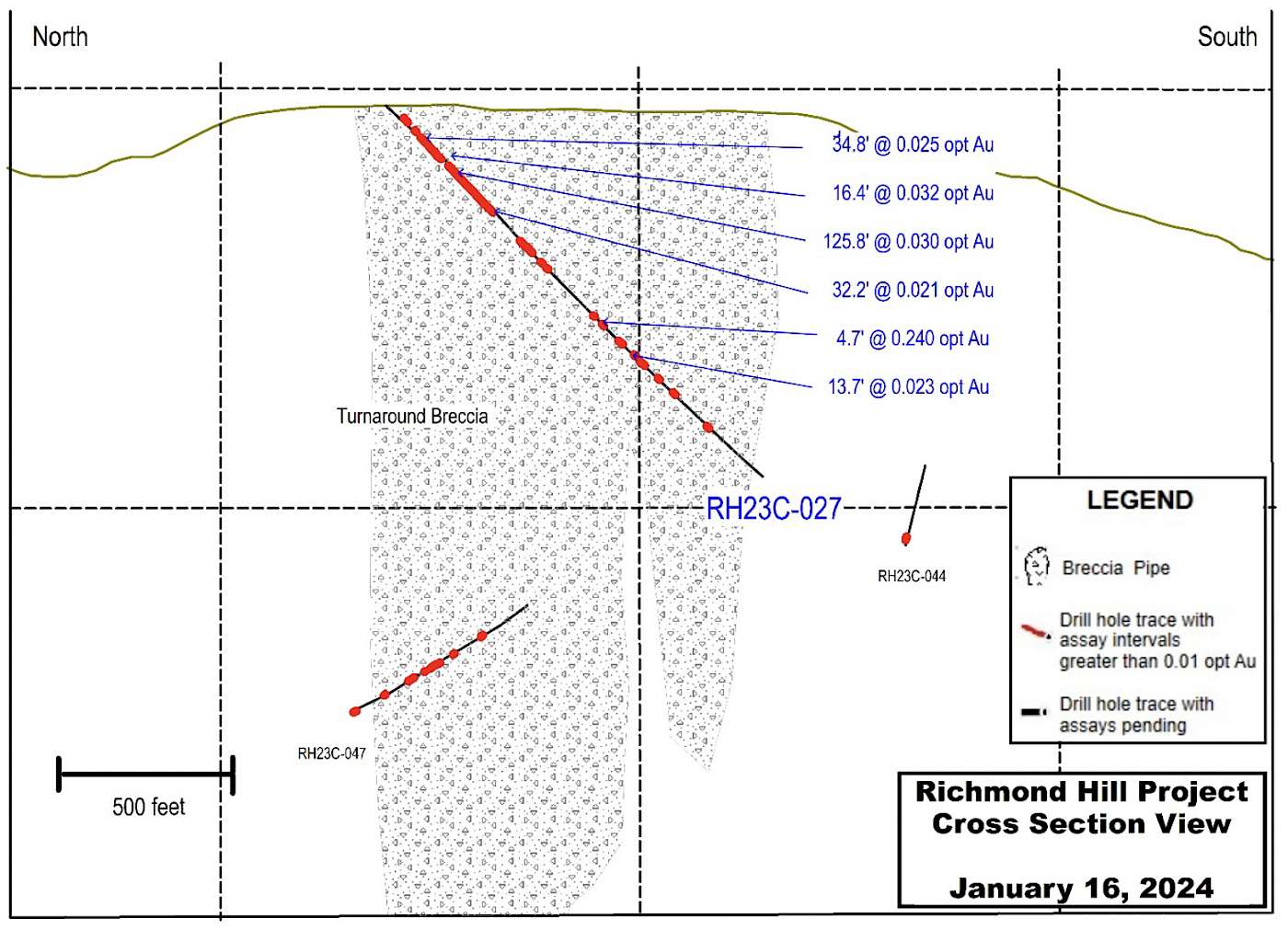

RH23C-027

RH23C-027 was designed to drill south through the southern lobe of the Turnaround Breccia Pipe. This drill hole returned numerous broad zones of gold mineralization in the breccia pipe with the best intercept being 0.030 oz/ton Au over 125.8 feet (1.03 grams/tonne over 38.3 meters). A narrow intercept of 0.240 oz/ton Au over 4.7 feet (8.24 grams/tonne over 1.4 meters) was also encountered deeper down the drill hole in Precambrian greenstone.

RH23C-028

RH23C-028 was designed to test the northwest side of the northern part of the Turnaround Breccia Pipe but at a steeper angle than RH23C-022. Several narrow intervals were intersected at depth.

RH23C-057

RH23C-057 was designed to validate historical resources below the historical Richmond Hill open pit mine and was drilled at a steeper angle than RH23C-054 from the same drill pad. It encountered similar shallow mineralized Precambrian rocks which occur outside the historical Richmond Hill open pit mine. The better intervals are 0.037 oz/ton Au over 15.6 feet (1.27 grams/tonne over 4.8 meters), 0.024 oz/ton Au over 55 feet (0.82 grams/tonne over 16.8 meters), and 0.054 oz/ton Au over 12.8 feet (1.85 grams/tonne over 3.9 meters).

RH23C-058

RH23C-058 was also designed to validate historical resources below the historical Richmond Hill open pit mine and was drilled at a steeper angle than RH23C-054 from the same drill pad. It encountered similar shallow mineralized Precambrian rocks also outside the historical Richmond Hill open pit mine. The better intervals are 0.023 oz/ton Au over 45.2 feet (0.79 grams/tonne over 13.8 meters), 0.041 oz/ton Au over 36 feet (1.41 grams/tonne over 11 meters), 0.078 oz/ton Au over 16.7 feet (2.67 grams/tonne over 5.1 meters), and 0.034 oz/ton Au over 31 feet (1.17 grams/tonne over 9.4 meters).

Table 1. RH23C-021, RH23C-022, RH23C-023, RH23C-025, RH23C-027, RH23C-028, RH23C-057 and RH23C-058 Drill Results (Imperial / Metric Units)

Abbreviations in the table include ounces per ton (“oz/ton”); grams per tonne (“g/t”); feet (“ft”); meter (“m”); Tertiary breccia hosted mineralization (“Bx”); Cambrian Deadwood Fm hosted Tertiary mineralization (“TꞒd”); Tertiary intrusive hosted mineralization (“Tert”); and Precambrian hosted Tertiary mineralization (“TpꞒ”).

Figure 1. Plan View of Dakota Gold Corp. Richmond Hill Drill Holes with Highlighted Gold Intercepts.

Figure 2. Cross Section View of Richmond Hill Drill Hole RH23C-022.

Figure 3. Cross Section View of Richmond Hill Drill Hole RH23C-025.

Figure 4. Cross Section View of Richmond Hill Drill Hole RH23C-027.

The Company currently has four drills operating on its properties in the Homestake District of South Dakota at the Maitland Gold Project (Maitland) and the Richmond Hill Gold Project. Richmond Hill is located 2.3 miles west of Maitland and 1.5 miles north of Coeur Mining, Inc.’s Wharf Mine. The Wharf Mine produced 79,768 ounces at 0.021 oz/ton gold in 2022

About Dakota Gold Corp.

Dakota Gold (NYSE American: DC) is a South Dakota-based responsible gold exploration and development company with a specific focus on revitalizing the Homestake District in Lead, South Dakota. Dakota Gold has high-caliber gold mineral properties covering over 46 thousand acres surrounding the historic Homestake Mine.

The Dakota Gold team is focused on new gold discoveries and opportunities that build on the legacy of the Homestake District and its 145 years of gold mining history.

Subscribe to Dakota Gold’s e-mail list at www.dakotagoldcorp.com to receive the latest news and other Company updates.

Shareholder and Investor Inquiries

For more information, please contact:

Jonathan Awde, President and Chief Executive Officer

Tel: +1 604-761-5251

Email: moc.procdlogatokad@edwAJ

Qualified Person and S-K 1300 Disclosure

James M. Berry, a Registered Member of SME and Vice President of Exploration of Dakota Gold Corp., is the Company’s designated qualified person for this news release as defined in Subpart 1300 - Disclosure by Registrants Engaged in Mining Operations of Regulation S-K and has reviewed and approved its scientific and technical content.

The ranges of potential tonnage and grade (or quality) disclosed above in respect of the Richmond Hill Gold Project are conceptual in nature and could change as the proposed exploration activities are completed. There has been insufficient exploration of the Richmond Hill Gold Project to allow for an estimate of a mineral resource and it is uncertain if further exploration will result in the estimation of a mineral resource. The disclosure above in respect of the Richmond Hill Gold Project therefore does not represent, and should not be construed to be, an estimate of a mineral resource or mineral reserve.

Quality Assurance/Quality Control consists of regular insertion of certified reference materials, duplicate samples, and blanks into the sample stream. Check samples will be submitted to an umpire laboratory as the drill program progresses. Assay results are reviewed, and discrepancies are investigated prior to incorporation into the Company database. Samples are submitted to the ALS Geochemistry sample preparation facility in Winnipeg, Manitoba. Gold and multi-element analyses are performed at the ALS Geochemistry laboratory in Vancouver, British Columbia. ALS Minerals is an ISO/IEC 17025:2017 accredited lab.

Forward Looking Statements

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are based on assumptions and expectations that may not be realized and are inherently subject to numerous risks and uncertainties, which could cause actual results to differ materially from these statements. These risks and uncertainties include, among others, the execution and timing of our planned exploration activities, our use and evaluation of historic data, our ability to achieve our strategic goals, the state of the economy and financial markets generally and the effect on our industry, and the market for our common stock. The foregoing list is not exhaustive. For additional information regarding factors that may cause actual results to differ materially from those indicated in our forward-looking statements, we refer you to the risk factors included in Item 1A of the Company’s Annual Report on Form 10-KT for the nine-month transition period ended December 31, 2022, as amended, as updated by annual, quarterly and other reports and documents that we file with the SEC. We caution investors not to place undue reliance on the forward-looking statements contained in this communication. These statements speak only as of the date of this communication, and we undertake no obligation to update or revise these statements, whether as a result of new information, future events or otherwise, except as may be required by law. We do not give any assurance that we will achieve our expectations.