Dakota Gold Corp. Discovers New JB Gold Zone at the Maitland Gold Project with Drill Hole MA23C-017 Intersecting 0.365 oz/ton Au over 15.3 Feet (12.51 grams/tonne over 4.7 meters)

May 4, 2023

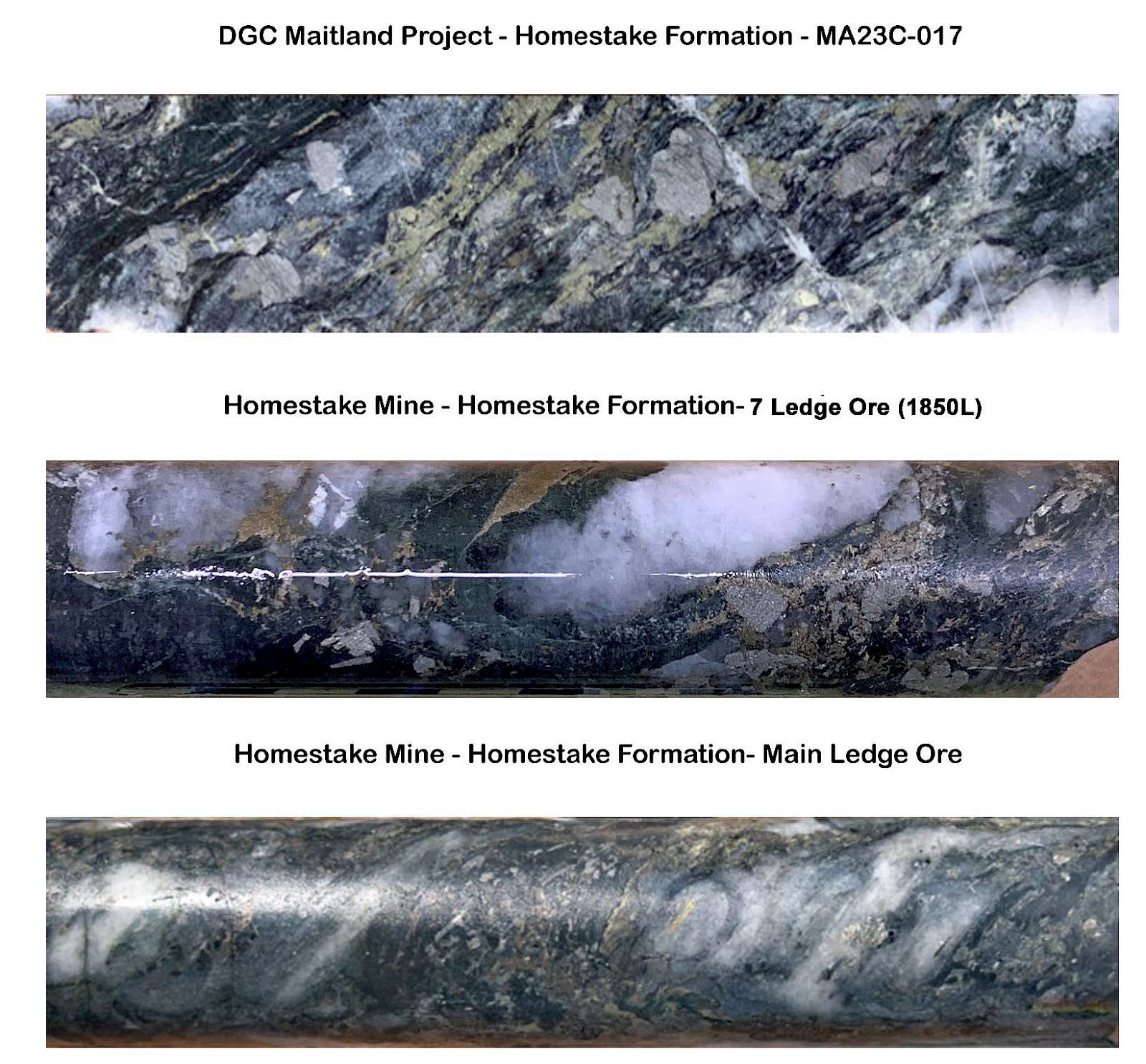

LEAD, SOUTH DAKOTA – Dakota Gold Corp. (NYSE American: DC) (“Dakota Gold” or the “Company”) is pleased to announce partial results from drill hole MA23C-017 at the Maitland Gold Project and the significant discovery of the new JB Gold Zone. The hole was drilled to the west to crosscut the Homestake stratigraphic sequence within the known structural corridor that extends northward from the Homestake Gold Mine, located approximately 3.4 miles (5.5 km) to the south. Drill hole MA23C-017 intersected 0.365 oz/ton Au over 15.3 feet (12.51 grams/tonne over 4.7 meters) in the same high-grade quartz-carbonate vein, chlorite-arsenopyrite-pyrrhotite mineralization style of the Homestake Mine. The hole is a 1,340-foot (408 meter) step-out to the Northwest from the previous Homestake intercept in drill hole MA22C-003 (0.292 oz/ton Au over 10.4 feet or 10.03 grams/tonne over 3.2 meters, see February 8, 2023 press release). The intersection in MA23C-017 occurs in a wider zone grading 0.204 oz/ton Au over 31.3 feet (7.0 grams/tonne Au over 9.5 meters).

Drill Hole MA23C-017 is the northern-most hole drilled to date by Dakota Gold, and conclusively demonstrates that the same mineralizing fluids that produced the +40-million-ounce Homestake gold deposit also deposited gold within the Maitland Gold Project area, on the same structural trend, with the same host lithology and metamorphic temperature gradient.

Drill Hole Highlights:

- MA23C-017 intersected 0.365 oz/ton Au over 15.3 feet (12.51 grams/tonne over 4.7 meters) within a wider zone grading 0.204 oz/ton Au over 31.3 feet (7.0 grams/tonne Au over 9.5 meters) in Homestake Formation.

- MA23C-017 is located 3.4 miles (5.5 km) from the Homestake Mine Open Cut and 1.8 miles (2.9 km) from Homestake Mining Company’s North Drift Discovery. The North Drift, MA22C-002, MA22C-003, and MA23C-017 intercepts lie within the Homestake Structural Corridor where isoclinally folded Homestake Iron Formation intersects strong North-Northwest trending shearing.

- The gold mineralization encountered in MA23C-017 is associated with quartz-carbonate veins with chlorite selvages and adjacent pyrrhotite-pyrite-arsenopyrite mineralogy. This alteration and mineralization are the same as the high-grade mineral zones found at the Homestake Mine.

James M. Berry, Vice President of Exploration of Dakota Gold, said, “As an exploration and production geologist at Homestake Mining Company (from 1991 to 2001), it was a common experience to drill large expanses of barren Homestake Formation before locating economic mineralization. Approximately 3% of the Homestake Formation in the +40-million-ounce deposit contained economic mineralization, at an average grade of approximately 0.238 oz/ton Au (8.16 grams/tonne Au). I am excited about our results in MA23C-017 as it is 3.5 miles north and along strike of the stopes where I worked in the Homestake Mine. With two potentially economic mineralized intersections in Drill Holes MA22C-003 and MA23C-017, we can now begin to vector our drilling into wider zones of gold mineralization.”

Dakota Gold’s Maitland Drill Program uses a systematic approach to exploration that was developed over the 125-year life of the Homestake Mine. Gold mineralization in the classic quartz-carbonate vein, chlorite, arsenopyrite-pyrrhotite style at Homestake does not occur randomly. The ledges at the Homestake Mine exhibited symmetry, with weaker disseminated gold values in the upper and lower tails of the ledge, with the largest high-grade orebodies found at the centroid. The property of ledge symmetry generally allows for vectoring off results to wider zones of higher-grade mineralization within the ledge. The Company is currently engaged in the early stages of the program at Maitland with the current drilling on wide spacing to define the geology, delineate preferential terrains for gold mineralization and to produce discoveries. The next phases of work are geared toward definition of the mineralized zones with drilling on tighter spacing and vectoring toward centroid mineralization.

Exploration Update:

MA23C-017

MA23C-017 was drilled as a significant step-out 1,340 feet (408 meters) Northwest of MA22C-003, intersecting 0.365 oz/ton Au over 15.3 feet (12.51 grams/tonne over 4.7 meters), the partial results of which are shown in Table 1 below. The true thickness of this interval is estimated to be 10.8 feet (3.3 meters). Prior to MA23C-017, MA22C-003 was the Company’s most northern drill hole, intersecting 0.292 oz/ton Au over 10.4 feet (10.03 grams/tonne over 3.2 meters, see February 8, 2023 press release).

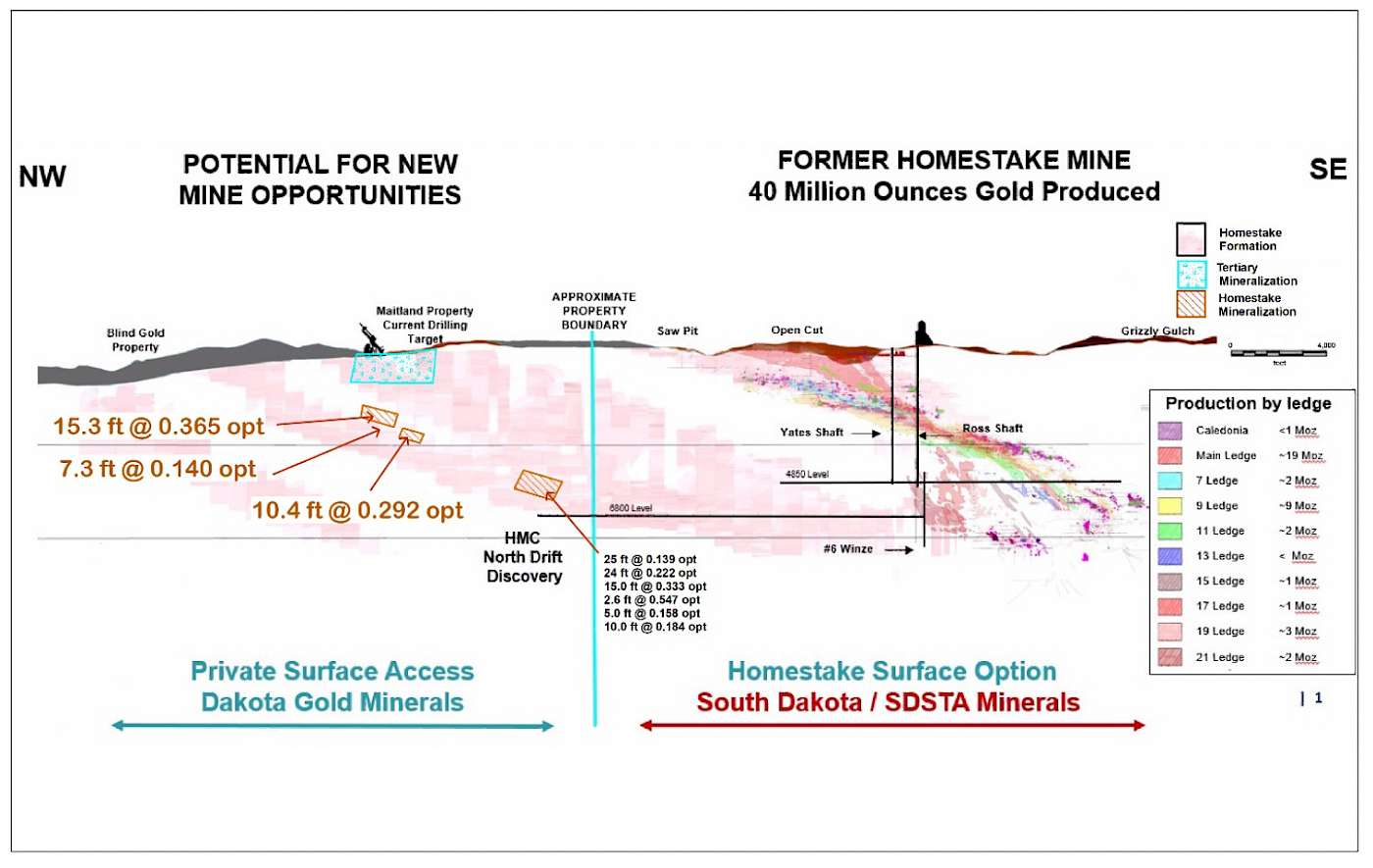

The long section in Figure 1 shows the location of the Homestake Mine, the North Drift Discovery and the Company’s MA23C-017 and MA22C-003 intercepts. The North Drift Discovery led Homestake to undertake a $70 million exploration program between 1988 and 1994, which has served as the foundation of Dakota Gold’s land acquisition and exploration programs. This was Homestake Mining Company’s last significant exploration program and was ceased because of steeply declining gold prices at the time and a decision to deploy capital elsewhere. The North Drift program intersected 0.333 oz/ton Au over 15 feet (11.43 grams/tonne over 4.6 meters), 0.139 oz/ton Au over 25 feet (4.77 grams/tonne over 7.6 meters), and 0.222 oz/ton Au over 24 feet (7.61 grams/tonne over 7.3 meters) all of which are on the Company’s property. These intercepts are historical and have not been verified by Dakota Gold.

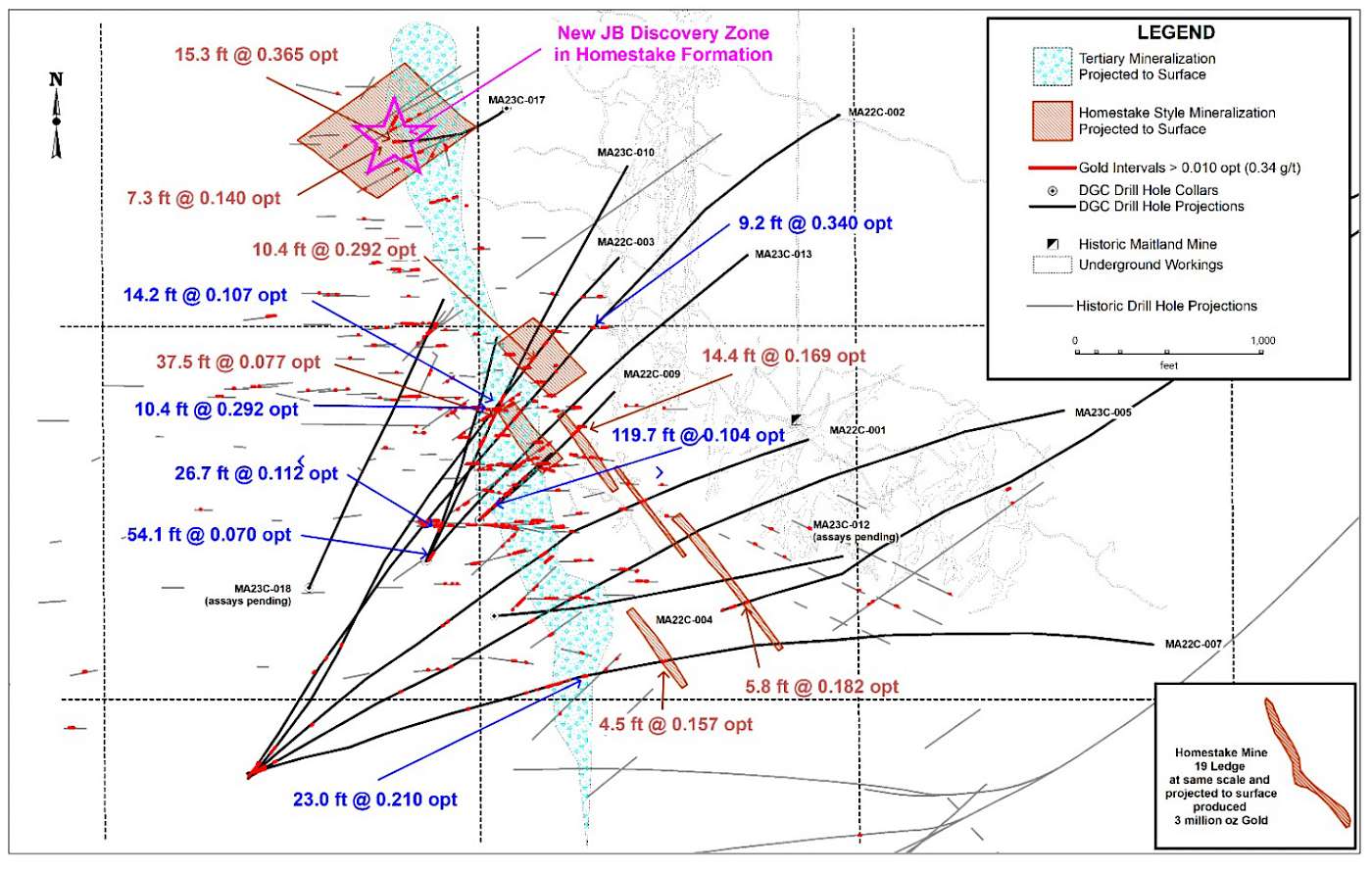

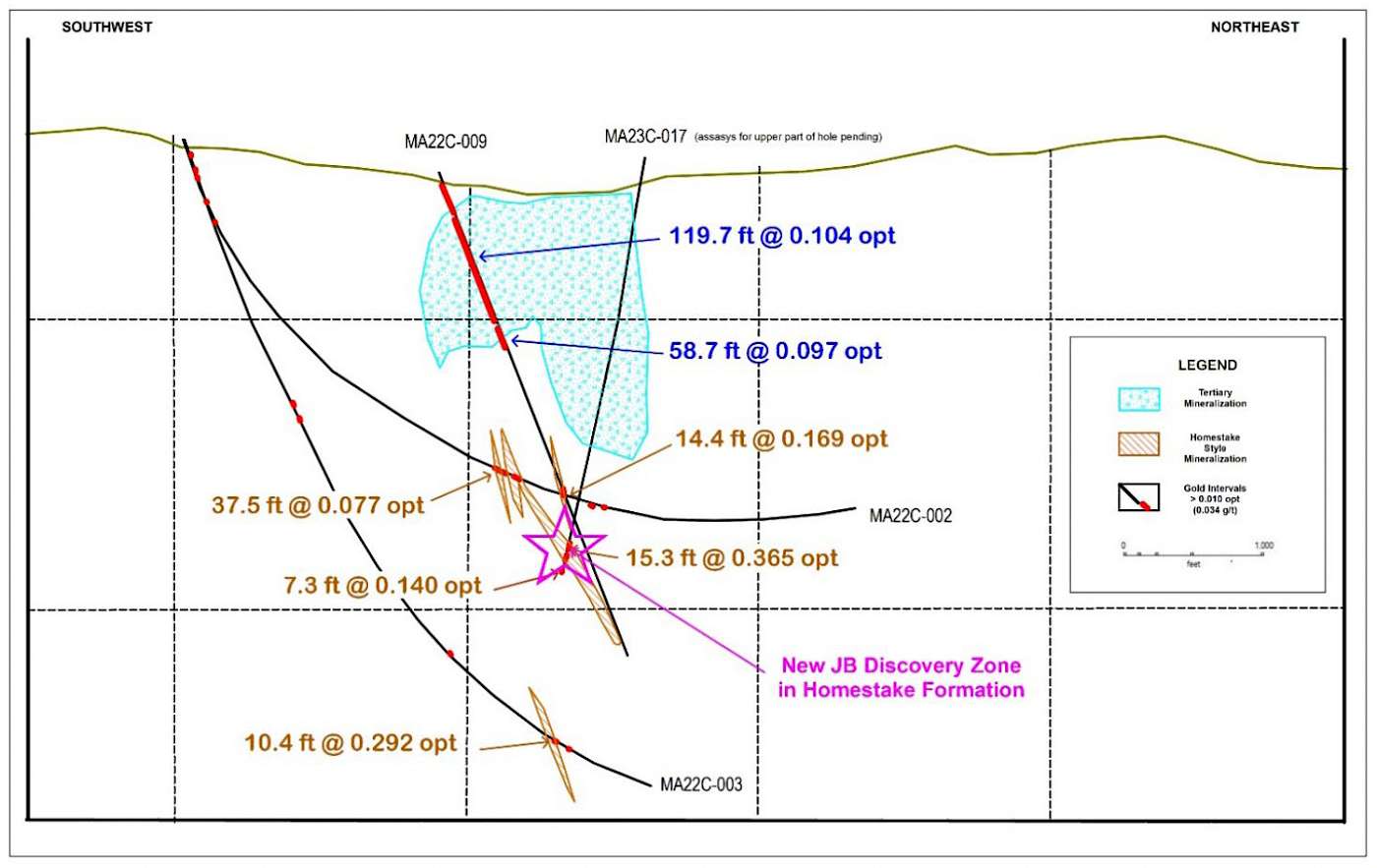

The Company intends to step-out from MA23C-017 to test continuity of the mineralization between MA22C-003 and MA23C-017. The intercepts in MA22C-003 and MA23C-17 remain open at depth and along strike (refer to Figure 2 and Figure 3).

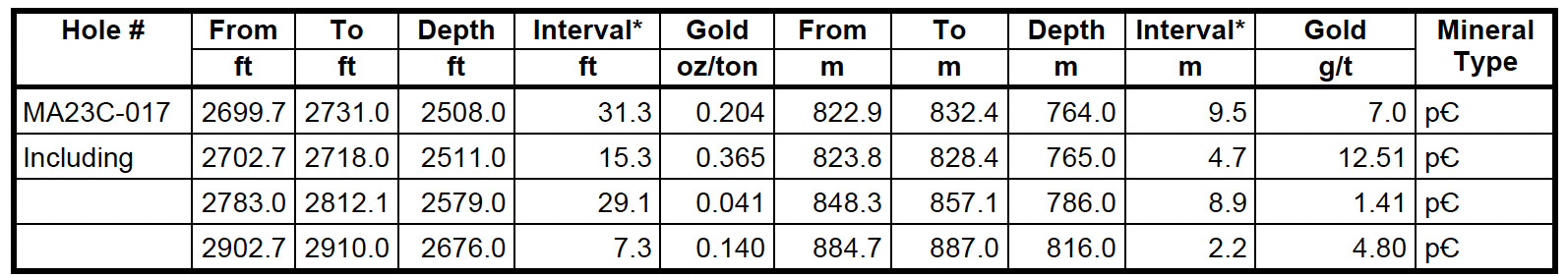

Table 1. MA23C-017 Partial Drill Results (Imperial / Metric Units)

*True thickness is unknown.

Abbreviations in the table include ounces per ton (“oz/ton”); grams per tonne (“g/t”); feet (“ft”); meter (“m”); Tertiary (“Tert”); Cambrian (“Ꞓ”); Breccia (Bx) and Precambrian (“pꞒ”).

The Company currently has four drills operating on its properties in the Homestake District of South Dakota, with two drills operating at the Maitland Gold Project (“Maitland”) targeting Homestake-hosted and Tertiary gold mineralization.

Two drills operating at Richmond Hill are targeting Tertiary breccia and replacement gold mineralization, as well as conducting infill and step-out drilling designed to convert and expand the known gold mineralization identified in 880 historic drill holes, to S-K 1300 compliant resources.

Richmond Hill is located 2.3 miles west of Maitland and 1.5 miles north of Coeur Mining, Inc.’s Wharf Mine. The Wharf Mine produced 79,768 ounces at 0.021 oz/ton gold in 2022.

Figure 1. Long Section of the Homestake Gold Mine, Homestake’s North Drift Discovery, and Dakota Gold’s Drill Intercepts.

Figure 2. Plan Map of Dakota Gold’s MA23C-017, MA22C-002, MA22C-003.

Figure 3. Cross Section along MA23C-017 Looking Northwest.

Figure 4. Core photo of MA23C-017 (Dakota Gold Corp) at 2,703 feet (823.9 meters) showing arsenopyrite, pyrite, and pyrrhotite mineralization adjacent to quartz-carbonate veins with chlorite selvages. A photo of Homestake Mine 7 Ledge ore (2 Moz @ 0.240 oz/ton Au) and Main Ledge ore are also shown for comparison (19 Moz @ 0.262 opt Au).

About Dakota Gold Corp.

Dakota Gold (NYSE American: DC) is a South Dakota-based responsible gold exploration and development company with a specific focus on revitalizing the Homestake District in Lead, South Dakota. Dakota Gold has high-caliber gold mineral properties covering over 46 thousand acres surrounding the historic Homestake Mine.

The Dakota Gold team is focused on new gold discoveries and opportunities that build on the legacy of the Homestake District and its 145 years of gold mining history.

Subscribe to Dakota Gold’s e-mail list at www.dakotagoldcorp.com to receive the latest news and other Company updates.

Shareholder and Investor Inquiries

For more information, please contact:

Jonathan Awde, President and Chief Executive Officer

Tel: +1 604-761-5251

Email: moc.procdlogatokad@edwAJ

Qualified Person and S-K 1300 Disclosure

James M. Berry, a Registered Member of SME and Vice President of Exploration of Dakota Gold Corp., is the Company’s designated qualified person for this news release as defined in Subpart 1300 - Disclosure by Registrants Engaged in Mining Operations of Regulation S-K and has reviewed and approved its scientific and technical content.

The ranges of potential tonnage and grade (or quality) disclosed above in respect of the Maitland Gold Project are conceptual in nature and could change as the proposed exploration activities are completed. There has been insufficient exploration of the Maitland Gold Project to allow for an estimate of a mineral resource and it is uncertain if further exploration will result in the estimation of a mineral resource. The disclosure above in respect of the Maitland Gold Project therefore does not represent, and should not be construed to be, an estimate of a mineral resource or mineral reserve.

Quality Assurance/Quality Control consists of regular insertion of certified reference materials, duplicate samples, and blanks into the sample stream. Check samples will be submitted to an umpire laboratory as the drill program progresses. Assay results are reviewed, and discrepancies are investigated prior to incorporation into the Company database. Samples are submitted to the ALS Geochemistry sample preparation facility in Winnipeg, Manitoba. Gold and multi-element analyses are performed at the ALS Geochemistry laboratory in Vancouver, British Columbia. ALS Minerals is an ISO/IEC 17025:2017 accredited lab.

Forward Looking Statements

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are based on assumptions and expectations that may not be realized and are inherently subject to numerous risks and uncertainties, which could cause actual results to differ materially from these statements. These risks and uncertainties include, among others, the execution and timing of our planned exploration activities, our use and evaluation of historic data, our ability to achieve our strategic goals, the state of the economy and financial markets generally and the effect on our industry, and the market for our common stock. The foregoing list is not exhaustive. For additional information regarding factors that may cause actual results to differ materially from those indicated in our forward-looking statements, we refer you to the risk factors included in Item 1A of the Company’s Annual Report on Form 10-KT for the nine-month transition period ended December 31, 2022, as amended, as updated by annual, quarterly and other reports and documents that we file with the SEC. We caution investors not to place undue reliance on the forward-looking statements contained in this communication. These statements speak only as of the date of this communication, and we undertake no obligation to update or revise these statements, whether as a result of new information, future events or otherwise, except as may be required by law. We do not give any assurance that we will achieve our expectations.